Market Watch - March 28, 2017

There are many changes occurring in our economy that have important financial implications. We will review (1) our present economic position, and outlook; (2) problems our economy faces; and (3) how these problems can be successfully addressed.

Present Economic Outlook

Our present economic situation could not be better, given the enormous burden of doubling public debt the last eight years. Businessmen have a hopeful outlook, as evidenced by the stock market obtaining many records over the last 90 days. National wealth has grown to $90 trillion, about 30% of the world’s net worth. It is amazing that the U.S., with 4% of the world’s population, enjoys 30% of the world’s wealth.

A reduction in government regulations, proposed reductions in taxes, and cleaning up trade agreements designed to lift the rest of the world, at our expense, are now something business fears less. No business wants to move off shore. Anytime business leaves this country it is because of taxes, costly legislation, unreasonable labor laws, mean spirited litigation, and over-burdening permitting processes. Businesses contemplating moving have recently put that thinking on hold.

Among the many things going well is that we have had 80 straight months of job growth. Our employment base is 145 million jobs, up 16 million from 2008. There are, additionally, 5 million jobs currently available and unfilled. Individuals and corporations have historically high amounts of cash. We currently enjoy low energy prices, coupled with record breaking corporate earnings.

Problems Our Economy Faces

GDP STATISTICS |

||||

NOMINAL |

||||

Date |

Average Annual GDP Growth Rate Previous 10 Years |

Governemnt Debt (Trillions) |

GDP (Trillions) |

% of Government Debt to GDP |

1976 |

2.97% |

.629 |

1.878 |

33% |

1996 |

3.0 |

5.181 |

8.100 |

64 |

2016 |

1.33 |

19.537 |

18.472 |

1.06 |

The problems we face are serious. The biggest problem is government spending and debt. Producers (farmers and businesses) pay all government salaries directly, or indirectly, through taxes. Government’s present consumption (revenues) has grown too fast for the economy to support them with further taxes, and remain competitive in world markets. Notice in the GDP statistics that the average annual GDP growth rate over many decades was around 3%, which number the new administration has said they are striving to obtain by the end of next year. GDP growth rate the 10 years prior to 2016, however, was only 1.3% annually. During that same period, national debt doubled, and then exceeded the total value of annual GDP. That is a point where any country is in serious trouble. Bond rating agencies begin to reduce their comfort level in countries when government debt exceeds 65% of GDP. Ours is now 106% of GDP. Getting debt under control is the number one challenge we face. U.S. bond ratings have already been downgraded, and put on alert that another downgrade is imminent, if the U.S. doesn’t get debt under control.

We also have a record number of illegals, with estimates of 12 million workers. Our labor non-participation rate of 32% is up from 19% 50-years ago. Many people only work if they have to. With 47 million people on food stamps, and a labor non-participation rate of 1/3 of eligible workers, there is an enormous amount of untapped productivity in the economy. Should welfare be cut, and as illegals are deported, the labor non-participation rate will drop. People who do not choose to work because things have been free will then need to seek jobs.

Addressing Economic Challenges

How do we address these problems? What is it that must be done to accelerate growth of the economy? The answer is pretty simple: reduce the size of government and put a hold on new government hiring; repatriate illegals, criminals and troublemakers to their homeland; cut un-needy welfare recipients; get rid of confusing regulations and burdensome healthcare laws. The power of private sector economic growth can get us out of our current state over a period of years.

All of the above-mentioned changes are under consideration. Business is no longer looking at the government as its enemy, but rather as its ally, as was intended when the Commerce Department was created by The Constitution. There is hope these changes create enough growth so that over years the government becomes significantly smaller as a percent of our GDP, which would make government affordable again.

|

Something else to consider that could positively affect the U.S. economy is the eminent breaking up of the European Economic Union (EEU). Greece has not made any of the requirements placed upon them by lending authorities. Portugal, Spain, Italy and France, as well as Ireland, are on the brink of bankruptcy. The break-up of the EEU will aid the United States, economically, in many ways. Unstable economic conditions will force European capital to flee. A good deal of that money will come to the United States because we are a safe haven. Money coming into banks will add to the lending base we have now, which additional supply of capital will serve to keep long term interest rates low.

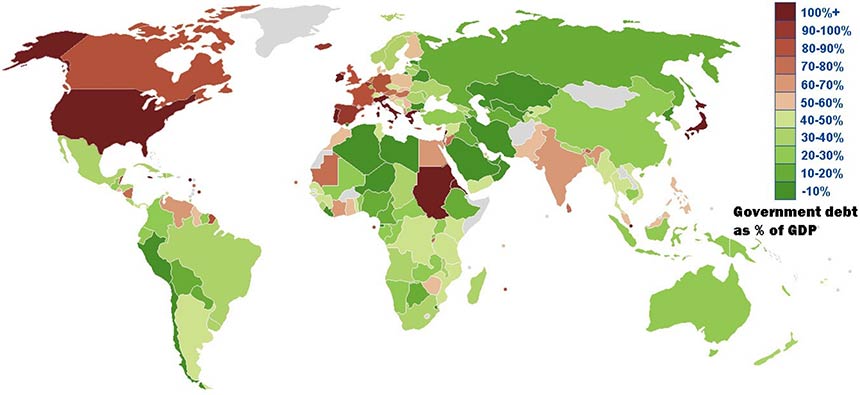

In looking at the attached map, the darkest colored countries all have debt greater than their GDP, including the United States. The only way the U.S. gets away with this is that we print the world’s money. The dollar is used in 70% of the world’s business transactions..

Conclusion

The world is an economic mess. The U.S. is saved by the power of our private economy, our ability to print money indiscriminately, and our enormous base of consumer spending which represents $13 trillion dollars annually, an astounding 15% of the world’s $82.5 trillion GDP. We are the world’s market.

The U.S. has been in desperate straights due to debt five times previously in our history. Should we get government expenditures, and regulations burdening business, to become reasonable, there is no economy in the world that can out produce, out think, and out work Americans.

Every week there are articles about the Fed and “when and how much” interest rates will increase. Interest rates will have no significant increase for at least a few years. Long term interest rates increase because demand for money exceeds available supply of loanable funds. Such will not be the case for awhile because individuals and businesses have more cash than ever; and thus have little demand for large loans. There already exists $2.5 trillion of unloaned funds in the banking system. The administration is preparing to allow another $2.5 trillion of U.S. corporate earnings overseas to return to the U.S. tax-free. Those deposits alone will more than double existing U.S. loanable funds before any help from foreign deposits seeking a safe place for funds. The Fed can only influence short-term rates. Significant business loans are financed long-term.

Dow Jones Industrial Average |

||

CURRENT |

LONG-TERM AVERAGE |

MARKET VALUE BASED UPON LT AVERAGE |

21,100 points |

N/A |

N/A |

PE 21x |

14.5x |

14,600 points |

Yield 2.3% |

4.1% |

11,850 points |

A word of caution about the stock market: the market currently bears a high price earnings ratio of 21 times trailing twelve months earnings (WSJ), as well as a historic low dividend yield of 2.3%. The average long-term price earnings ratio is 14.5 times earnings, and the average long-term dividend yield is 4.1%. Should the market seek either of those long-term averages, instead of exceeding 21,000 points, the Dow would be somewhere between 12,000 to 14,500 points, as indicated by the chart. The market is not a bargain, and has had no “standard” 10% correction for many years. While a correction beyond 10% is unexpected, small corrections are inevitable, and they come unannounced.

The outlook is superb if we stay the course. U.S. earnings and cash flow should continue to increase. These types of changes will give American workers hope that they can work, save and have job security in a growing and expanding economy.

Carpe Diem.

George Rauch

March 28, 2017