Market Watch - April 10, 2015

There is very little to say that is bad about the existing economy, short-term. A lot of potential problems exist long-term. Let’s take a look at how we got to such a strong economy.

Economy Booming like Never Before

Chart 1 shows the deficits created each year by the Bush and Obama administrations. All numbers are ‘actual’ except for the last two years of the Obama Administration, which are estimates. New presidents inherit, during their first year in office, the budget of their predecessor. For example, President Bush inherited the $158 billion deficit in 2002 from President Clinton. The $1.293 trillion deficit in Obama’s first year was inherited from the last Bush administration budget. These two presidents will have added $10.1 trillion to the financial liabilities of the United States. All of the money was created out of nothing. Funds went to welfare recipients of means tested programs (not Social Security, Medicare and unemployment compensation that working people have paid into).

Budget Deficits by Fiscal Year Since 2002 |

|||

| Fiscal Year | George W. Bush | Fiscal Year | Barack Obama |

| 2002 | $158 | 2010 | $1,293 |

| 2003 | $378 | 2011 | $1,552 |

| 2004 | $413 | 2012 | $1,087 |

| 2005 | $318 | 2013 | $680 |

| 2006 | $248 | 2014 | $649 |

| 2007 | $161 | 2015 | $564 |

| 2008 | $458 | 2016 | $531 |

| 2009 | $1,160 | 2017 | $458 |

| Total | $3,294 | Total | $6,814 |

This large amount of newly created money is sitting in commercial banks ready to lend. Interest rates are favorable; banks, businesses and individuals have more cash, and more wealth, than any other time in history. Huge federal deficits have contributed mightily to the prosperity America enjoys today. We got to this point because of federal government deficit spending the last two administrations. In doing so we definitely borrowed from the future to enjoy current prosperity. The politician’s hope is that enough of that newly created money ends up invested in economically productive assets, which assets will earn enough over the lifetime of their use to pay off the newly created $10 trillion, plus interest.

Current and Intermediate Term Outlook

Our economy has come a long way the last five years. More than 10 million new jobs have been created. Increasing real estate values, coupled with record stock market values, are measures of the good fortune enjoyed by Americans. Both large corporations and small businesses are creating record profits. American productivity has had huge increases the last several years, which has lowered our domestic cost of production. The big decrease in the cost of oil benefits Americans more than anybody because, in addition to falling oil prices, the dollar has increased in price 22% over the last few months. Oil is priced in U. S. dollars. The benefit to America is that the cost of production for us is less than the cost of production for most of our competitors.

U. S. public outlook towards business is very positive as witnessed by the record stock market. All but 3% of mutual fund money is invested, a very low percentage of money to be left in cash. Mutual funds expect future stock market prosperity, and their expectations are greater than ever before.

Where can U. S. corporations find new Markets?

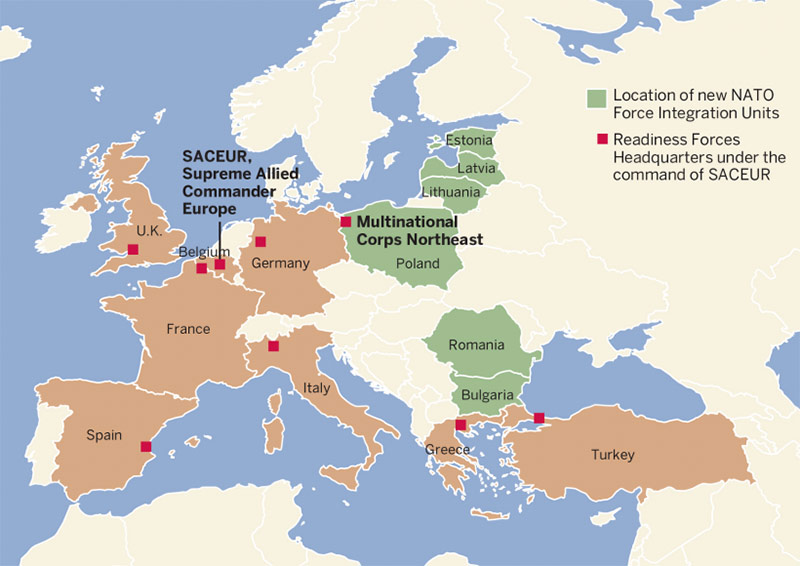

Chart 2 is an interesting look at just one area where a good deal of U. S. expansion is expected the next several years. Notice that NATO has moved most of its ready units hundreds of miles east towards Russia. This area is half as large as the Louisiana Territory but has millions and millions of people as potential customers, most of whom are literate. It also represents a tremendous acquisition of property for the free world that has pretty much gone unrealized by the public. In addition to a big reduction in past Russian trading markets, Russia is further contained. Because of her problems in Ukraine, and the collapse of the Russian economy occurring now, they should not be a threat to NATO forces near term.

CHART 2

In the meantime, U. S. corporations are making huge investments in hotels, manufacturing, and infrastructure in Eastern Europe, a territory once controlled by Russia. Russia can’t compete with the U. S. in Europe because their currency just crashed and has insufficient purchasing power. European countries can’t compete with the U. S. in Eastern Europe because the Euro is going down in value and facing great pressure from problems like Greece. The demand for American goods is great, and those markets should help the growth of large U. S. multi-national corporations in the foreseeable future.

There are many other great markets out there. U. S. manufacturing opportunities exist around the world where other currencies have depreciated substantially against the dollar like Sweden (22%), Brazil (30%), Western Europe (22%) and Japan (16%).

With the dollar up 20% this year, it buys a lot more overseas. It is more expensive now for the rest of the world to buy goods made in America, so U. S. corporations will use dollars to build facilities overseas from which goods can be shipped to other countries.

Long-term Outlook

The long-term outlook is just plain blurry. Low oil prices, a strong dollar, and loads of cash indicate intermediate term sledding looks good, but the future is blurry. This $18 trillion U. S. debt could crush us if not gotten under control. As we have all learned in our lives, debt is great in bull markets, and in bear markets, debt demoralizes and breaks us.

106 million people on welfare means 1/3 of our population is not supporting itself. The rest of the population cannot support 1/3 of their countrymen ad infinitum. The government is already borrowing money just to pay the interest on debt created to sustain the 106 million Americans on welfare. This is not healthy and it cannot continue. Further, there is not a program in place, or one being seriously considered, that can solve any of these problems.

Europe has now decided to make 55 billion new Euros (equal to $60 billion) every month to “stimulate their economy”. They are copying what we have done for the last decade by bailing out countries like Greece whose politicians are demanding loans in order to make the welfare payments to citizens “who are dependent upon welfare”. They are hoping this form of stimulus will put their economies in as good a stead as the stimulus has put this economy. That is not likely to happen because Eurozone workers are not as productive as Americans. Coupled with quarreling governments, and the outsized annual deficits of the southern European countries, Europe is a lot less likely to penetrate new markets than American companies.

Summary

All of this is wonderful short-term and has the potential to make us a lot of money. As always, the question in the long run is “who is going to pay for all of this?”

So is our current situation Bush’s fault or Obama’s fault? It’s both, and it’s ironical that this great economy is a result of poor economic choices made by our last two presidents.

Unfortunately, the day of reckoning will be very painful. Now, however, it’s nice to ride the train.

George Rauch

April 10, 2015